Enstar Announces Reinsurance of Zurich Australia’s New South Wales Motor Vehicle Compulsory Third Party Insurance Business

Feb 22, 2018

Under the reinsurance, which is effective as of

Following the initial reinsurance, which will transfer the economics of the CTP insurance business to Enstar’s subsidiary, the parties will pursue a portfolio transfer of the CTP insurance business under Division 3A of Part III of Australia’s Insurance Act 1973 (Cth), which would provide legal finality for Zurich. The Division 3A transfer is subject to court, regulatory and other approvals.

Commenting on the transaction,

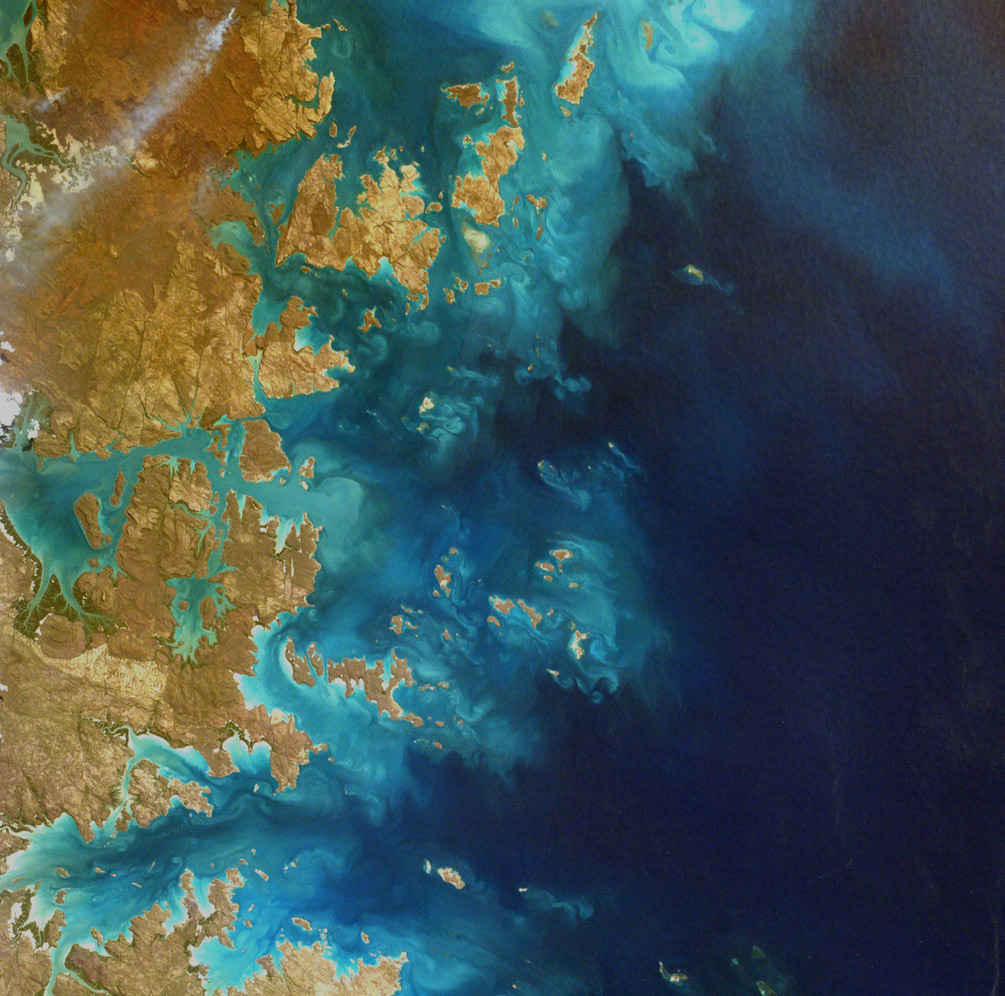

“This transaction with Zurich builds on Enstar’s successful management of other large Australian legacy portfolios. It significantly enhances our footprint in

About

Cautionary Statement

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding the intent, belief or current expectations of

Contact:

Telephone: +1 (441) 292-3645

Source: Enstar Group Limited